GHANA COMMODITY EXCHANGE SPECIAL REPORT ON COMMODITIES AND COMMODITY INDEX

Introduction

A commodity index tracks a basket of commodities to measure their price and investment return performance. However, indexes are not only created to be traded or for investment purposes but can be used to track global food prices or inflation. An example is the Consumer Price Index (CPI). Indexes are often traded on Exchanges, thus allowing investors who might not be interested in the physical commodity to gain easier investment access without entering a futures market. Indexes track the average upward and downward trends of the underlying commodities it comprises. Commodities indexes are traded like that of the Stock indexes and Exchange Traded Funds (ETFs).

One of the main objectives of the establishment of the Ghana Commodity Exchange is to provide market information. This is essential in promoting transparency in structured markets, thus boosting confidence and increasing participation of market actors. As part of efforts to develop structured trading environment of commodities, the Ghana Commodity Exchange has developed a commodity index not to be used for purposes of trading at this stage, but rather as a market information tool.

Industry Analysis

The agricultural sector in Ghana is pivotal to national development because of its huge role in creating employment especially in rural areas, food and income security, and provision of raw materials for industry. The sector makes about 20.3% contribution to gross domestic product through the export of agricultural commodities including cocoa and nontraditional export crops especially fresh fruits (FAO). In 2019, the growth rate of the agricultural sector was 6.9%, with a share of 17.32% of Ghana’s GDP translating to USD 11.84 billion, driven largely by government policy and expenditure (MOFA). According to the Ghana Statistical Service (2020), in the third quarter of 2019, agriculture grew 5.5% year-over-year, outpacing the same year’s general non-oil GDP growth. Industrialization and productivity improvement programs are expected to increase the output of the agriculture sector, create jobs, and encourage greater participation by the private sector. The growth rate of the agricultural sector rose by 0.1% to 7% in 2020, with a share of 18.85% of Ghana’s GDP, resulting to USD 13.2 billion (World Bank). The growth rate however fell to 6.6% in 2021, with a share of 19.71% of Ghana’s GDP, which amounted to USD 15.69 billion (Statista, 2021). COVID-19 had a direct and negative impact on agriculture in the country due to the disrupted distribution channels and shortage of labour. As there was a strict lockdown in Ghana, labourers could not go to the field and work due to the lack of transportation. There was a delay in the harvesting of crops which resulted in lower yields than normal, further hindering the growth of the agriculture sector in the country. In 2022, the sectorial growth rate was 6.9%, which made up USD 13.57 billion (share of 18.78% of Ghana’s GDP) (Statista, 2022). The sector is expected to grow, with the advent of the Enhanced Planting for Food and Jobs Programme, which promises to churn an annual average of 210,000 new farm-related jobs (Citi newsroom 2023), provide 50% subsidy of the cost of inputs (seeds and fertilizers, and extension services and marketing of outputs (MOFA, 2023.

Maize Market Insights

Maize is the most important cereal produced in Ghana, accounting for 74% of the total cereal production (MOFA 2005), which translates to about 2.1 million metric tons annually, with a consumption of 1.7 million metric tons. The middle belt and northern Ghana house the maize basket. The middle belt has two production seasons: primary season (April-August/September) and minor season (September/ December). Moreover, there is a limited window to dry their maize on the field before the rains start. Therefore, they experience more price fluctuations. The northern region has one production season of June-October, but the maize is left in the field to dry until late November/December. Ghanaian maize production is projected to reach 3.3 million metric tons by 2026 (Mordor Intelligence). The global Maize Market size is expected to grow from USD 139.42 billion in 2023 to USD 161.70 billion by 2028, at a compound annual growth rate (CAGR) of 3.01% during the forecast period (2023-2028) (Mordor Intelligence). The African maize market is expected to register a CAGR of 4.3% during the forecast period (2023 – 2028 (Mordor Intelligence).

In 2020, Ghana’s maize production was projected to reach 3.0 million metric tonnes (Daily Guide, 2021). However, several factors resulted in the production dropping to around 1.8 million metric tonnes. Due to inadequate rainfall, the major season of the southern and middle zones in 2020 where dry spells in March and April led to many farmers losing their crops (Daily Guide, 2021). Farmers were again hit by another dry spell in July and August when the minor season was just beginning, and many farmers lost their crops at the seeding stage (Daily Guide, 2021). In the northern zone, which contributes 40% of the country’s maize production, a similar situation also unfolded (Daily Guide, 2021). There were periods of dry spells between August and September followed by severe flooding from the spillage of the Bagre Dam, destroying farms in the process (Daily Guide, 2021). This drove up prices, in relation to the limited supply of the commodity.

Soybean Market Insights

Ghana's soybean production potential is at an impressive 700,000 tonnes per year (United Nations in Ghana, 2023). “Domestic demand of soybean grains is in excess of 300,000 MTs annually, of which 91% is used for industrial purposes in Ghana” (ScienceDirect, 2021). However, local supply stands at 144,926 MTs with a deficit of more than 150,000 MT, and this is often augmented through importation from countries such as Brazil and China (ScienceDirect, 2021). Farmers in the Northern sector of the country, who mainly grow soy as a cash crop, generate about 70 percent of Ghana's soya bean produce (ScienceDirect, 2021). “Average soya bean crop yields are low, ranging from 0.7 to 1.7 metric tons per hectare depending on variety, the environment, and management practices used” (SRID 2017).

In 2022, The Ministry of Food and Agriculture (MoFA) authorised five Ghanaian soybean-producing companies to export a recommended quantity of the commodity worth US$13.7million due to increasing demands from external markets, and the excess availability of the product in Ghana. The five companies, according to MoFA, were expected to export the approved commodity to meet high demands in India, China, Italy, Turkey and Canada (Agroriches, 2022).

GCX Commodity Index

As mentioned earlier, commodity indexes are used to track global food prices or inflation among other uses. The Ghana Commodity Exchange has developed two commodity indexes to be used as a market information tool. These are the GCX Graded Commodity Index (GCX-GCI) and the GCX Open Market Commodity Index (GCX-OMCI). These indexes make use of the Price-Weighted Methodology with a base value of 100.

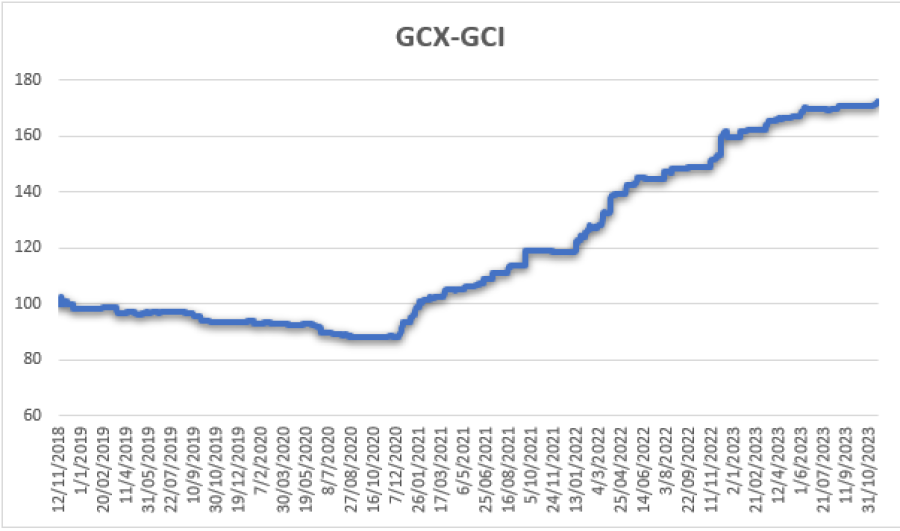

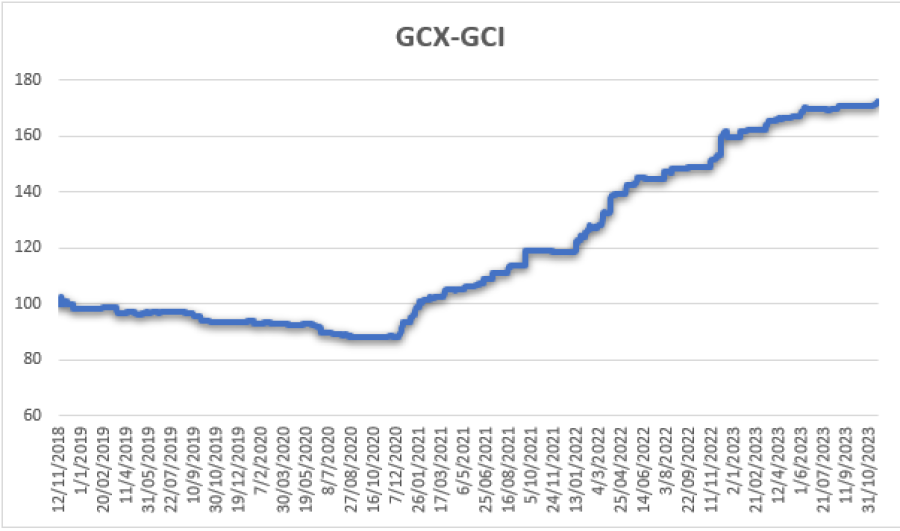

The GCX Graded Commodity Index tracks the prices and returns of graded maize and soybean commodities traded across eight (8) delivery centres of the Ghana Commodity Exchange. The closing prices of the commodities traded at these delivery centers, namely Afram Plains, Ejura, Kintampo, Kumasi, Wa, Wenchi, Tamale and Sandema was used in the index calculation. A chart of the index is shown below covering the period January 3, 2018, to November 20, 2023.

Fig 1. The GCX Commodity Index

The index averaged 98.13 points on the last day of 2018, after it opened at 102.48 points on November 19, 2018. It continued to fall and reached its lowest in October 2020 at 87.16 points.

This observation can be attributed to the measures put in place to counter the effects of the COVID-19 pandemic. The lock downs hampered production and the logistics value chain, amidst economic uncertainty. The index plateaued in Q3 of 2021, and continued rising at an increasing rate, from the onset the Russia-Ukraine war in February 2022.

The year 2022 was marked by an increase in domestic and external borrowing to curb the effects of the depreciating cedi, rising inflation, and in particular food inflation which was at 59.7% (Statista, 2023). Maize and soybean experienced an uptick in prices, as shown by the graph for the first half of 2022. It then peaked at 171.65 in November 2023.

The YTD performance of the GCX-GCI for 2023 is 7.14% (+11.4).

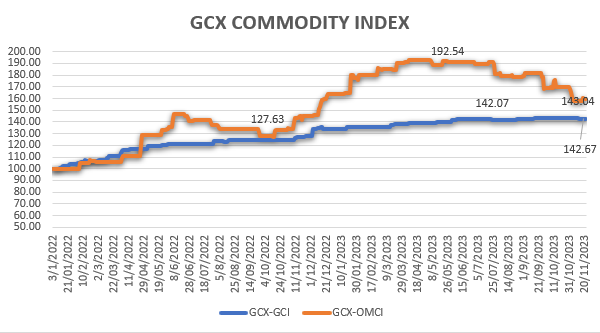

The chart below shows a comparative presentation of the GCX Graded Commodity Index and the GCX Open Market Commodity Index, allowing one to observe relative trend patterns more clearly. The period covered by these charts is from January 2022 to November 2023, spanning Maize and Soybean commodities from GCX delivery centres and key open markets (namely Sandema, Wenchi, Nkoranza, Bolga, Tumu, Wa and Techiman) across the country.

Fig 1. The GCX Graded Commodity Index and GCX Open Market Commodity Index

After falling to 127.63 points in October 2022, to be equal to the GCX-GCI, the GCX-OMCI rose and peaked at 192.54 in April 2023. The sharp rise can be attributed to rising food inflation, cost of fuel and low production to existing demand of the commodities. The GCX-OMCI started falling from June 2023 to 143.04 points, but it was still higher than the 142.67 points of the GCX-GCI. The GCX-GCI experienced smaller increases in the same period due to low trades. It however peaked at 148.95 on November 13, 2023.

Conclusion

From a long history of similar pricing trends and seasonality in the preceding ten years, the prices of maize and soybean have since increased over the last five years, as captured in the indices above. Factors are varied, and include global events, leading to supply chain challenges as well as high cost of production inputs, and climate change, which is an area that must be closely monitored, with strategies designed to promote sustainability.

From this week, the Ghana Commodity Exchange will share the GCX Commodity Index, to inform the public on the price trends of maize and soybean, its widest traded commodities. The Index will be published weekly.

About Ghana Commodity Exchange

The Ghana Commodity Exchange is a regulated market linking buyers and sellers of listed commodities while assuring the market quantity and quality, timely delivery and settlement.

CORPORATE INFORMATION

Ghana Commodity Exchange

2nd Floor, Africa Trade House, Ambassadorial Enclave, Liberia Road Ridge Tel: +233 (0)302 937 677

- GHANA COMMODITY EXCHANGE BOARD INAUGURATED

- FOR IMMEDIATE RELEASE: GCX ANNOUNCES RELOCATION OF TAMALE WAREHOUSE

- CAPITAL MARKET UNIT OF MINISTRY OF FINANCE PAYS FAMILIARIZATION VISIT TO GCX

- GCX PARTNERS WITH WORLD VISION AND OTHER KEY STAKEHOLDERS TO SIGN MOU FOR TRANSFORMING HOUSEHOLD RESILIENCE IN VULNERABLE ENVIRONMENTS